Term vs Whole Life Insurance Quotes: Which Is Better for You? sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

The discussion delves into the nuances of term life insurance versus whole life insurance, shedding light on the intricacies of each type and helping readers navigate the complexities of choosing the right insurance policy.

Term Life Insurance

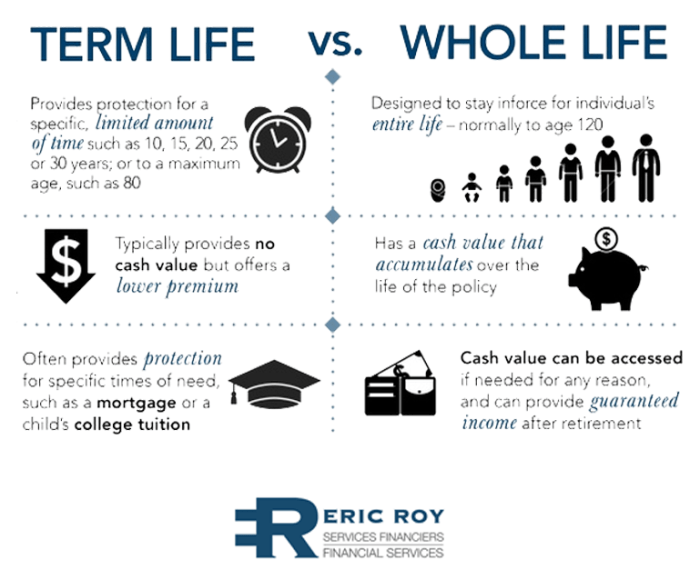

Term life insurance is a type of life insurance that provides coverage for a specific period of time, typically ranging from 10 to 30 years. If the insured individual passes away during the term of the policy, a death benefit is paid out to the beneficiaries.

Comparison with Whole Life Insurance

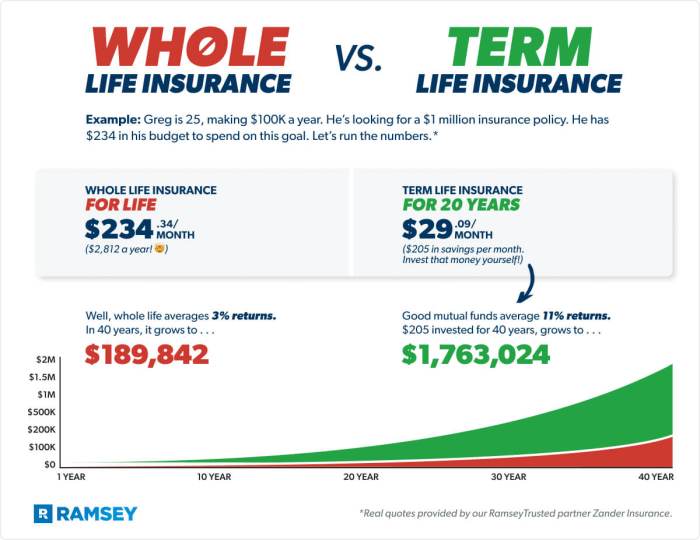

- Term life insurance offers coverage for a specific term, while whole life insurance provides coverage for the entire lifetime of the insured.

- Term life insurance premiums are typically lower than whole life insurance premiums, making it a more affordable option for many individuals.

- Term life insurance does not have a cash value component like whole life insurance, which can be used as an investment vehicle.

Benefits for Different Life Stages

Term life insurance can be beneficial for individuals at various stages of life:

- Young adults: Term life insurance can provide affordable coverage for young adults who are just starting their careers and have financial obligations, such as student loans.

- Parents: Term life insurance can help parents ensure that their children are financially protected in the event of their untimely death.

- Retirees: Term life insurance can be used to cover outstanding debts or funeral expenses, providing peace of mind to retirees and their loved ones.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. Unlike term life insurance, which offers coverage for a specific period, whole life insurance guarantees a death benefit payout to the beneficiaries whenever the insured passes away.

In addition to the death benefit, whole life insurance also includes a cash value component that grows over time.

Benefits of Whole Life Insurance

- Guaranteed coverage for life: Whole life insurance ensures that your beneficiaries will receive a death benefit no matter when you pass away.

- Accumulation of cash value: The cash value component of whole life insurance grows over time on a tax-deferred basis, providing a source of savings that can be accessed through loans or withdrawals.

- Fixed premiums: With whole life insurance, the premiums remain level for the entire life of the policy, providing predictability and stability in financial planning.

Investment Component of Whole Life Insurance

Whole life insurance policies have a built-in savings component that allows policyholders to accumulate cash value over time. A portion of the premium payments goes towards funding the cash value, which grows at a guaranteed rate set by the insurance company.

This cash value can be accessed during the policyholder's lifetime through policy loans or withdrawals, providing a source of tax-advantaged savings.Overall, whole life insurance offers a combination of lifelong coverage, cash value accumulation, and stable premiums, making it a suitable option for individuals looking for permanent life insurance protection with an investment component.

Premiums and Quotes

Term life insurance premiums are calculated based on factors such as the insured individual's age, health status, coverage amount, and term length. Since term life insurance provides coverage for a specific period, typically 10, 20, or 30 years, premiums are generally lower compared to whole life insurance.

Premiums for Term vs. Whole Life Insurance

- Term life insurance premiums are typically lower than whole life insurance premiums due to the temporary nature of coverage.

- Whole life insurance premiums are higher because they provide coverage for the entire lifetime of the insured individual.

- Term life insurance premiums may increase when the policy is renewed after the initial term expires, based on the insured's age and health at the time of renewal.

- Whole life insurance premiums remain level throughout the policyholder's life, providing a sense of financial predictability.

Factors Influencing Insurance Quotes

- For term life insurance, factors such as age, health condition, coverage amount, term length, and any additional riders can influence insurance quotes.

- Whole life insurance quotes are affected by similar factors, but also consider the cash value component, which accumulates over time and contributes to the policy's overall cost.

- Health plays a crucial role in determining insurance quotes for both types of policies, with better health leading to lower premiums.

- Occupation, lifestyle habits, and family medical history can also impact insurance quotes by influencing the perceived risk of insuring the individual.

Flexibility and Coverage

When it comes to life insurance, understanding the flexibility and coverage options is crucial to making an informed decision that fits your needs and budget. Let's delve into the details of how term and whole life insurance policies differ in terms of coverage flexibility.

Term Life Insurance Coverage Options

Term life insurance offers a straightforward approach to coverage, providing a death benefit for a specified period, such as 10, 20, or 30 years. This type of policy is known for its flexibility in terms of choosing the coverage amount and duration based on your individual circumstances and financial goals.

- Flexible coverage amounts ranging from $100,000 to several million dollars.

- Options to customize the term length to align with your financial obligations, such as mortgage payments or children's education expenses.

- Ability to convert to a whole life policy or renew the term policy at the end of the term.

Whole Life Insurance Coverage Options

Whole life insurance, on the other hand, offers coverage for your entire life, along with a cash value component that grows over time. This type of policy provides more permanent coverage and additional benefits compared to term life insurance.

- Guaranteed coverage for life, as long as premiums are paid.

- Builds cash value that can be borrowed against or used to pay premiums in the future.

- Potential to receive dividends or participate in the insurer's investment performance.

Comparison of Coverage Levels

When comparing the level of coverage provided by term and whole life insurance, it's important to consider your long-term financial goals and protection needs. Term life insurance typically offers higher coverage amounts for lower premiums, making it a cost-effective choice for temporary needs.

On the other hand, whole life insurance provides permanent coverage with the added benefit of accumulating cash value over time, but it comes with higher premiums.

Suitability and Considerations

When considering life insurance options, it's crucial to assess your individual needs and financial goals to determine which type of policy is the most suitable for you.

Factors Favoring Term Life Insurance

- Term life insurance is typically more affordable compared to whole life insurance, making it a suitable choice for individuals on a tight budget.

- Young individuals who need coverage for a specific period, such as until their mortgage is paid off or their children are grown, may find term life insurance more suitable.

- Term life insurance is straightforward and easy to understand, making it a convenient option for those who prefer simplicity in their insurance policies.

Considerations for Whole Life Insurance

- Whole life insurance offers lifelong coverage and includes a cash value component, which can be appealing for individuals looking for both protection and investment.

- Individuals who are looking to build cash value over time and have a long-term financial plan may find whole life insurance more suitable.

- Whole life insurance provides guaranteed death benefits, which can offer peace of mind to policyholders and their beneficiaries.

Situational Examples

- If you are a young parent looking to secure financial protection for your children until they are financially independent, term life insurance may be more suitable due to its affordability and coverage duration.

- On the other hand, if you are a high-income earner with substantial assets looking to maximize your wealth and leave a legacy for future generations, whole life insurance could be a better choice for its lifelong coverage and investment features.

- In cases where a temporary financial need, such as paying off a specific debt or funding a child's education, is the primary concern, term life insurance may be the more suitable option due to its cost-effectiveness and flexibility.

Closure

In conclusion, the comparison between term and whole life insurance unveils the unique benefits and considerations associated with each, empowering individuals to make informed decisions based on their financial goals and personal circumstances.

Answers to Common Questions

Which type of insurance is better for young individuals just starting their careers?

Term life insurance may be more suitable for young individuals starting their careers due to its lower premiums, providing essential coverage during the initial phase of their professional life.

What factors should one consider when deciding between term and whole life insurance?

Factors such as financial goals, budget, long-term needs, and investment preferences play a crucial role in determining whether term or whole life insurance is a better fit for an individual.

Can term life insurance be converted to whole life insurance later on?

Some term life insurance policies offer the option to convert to whole life insurance at a later stage, providing policyholders with flexibility in adjusting their coverage based on changing circumstances.